Today’s Rates – National Mortgage Averages

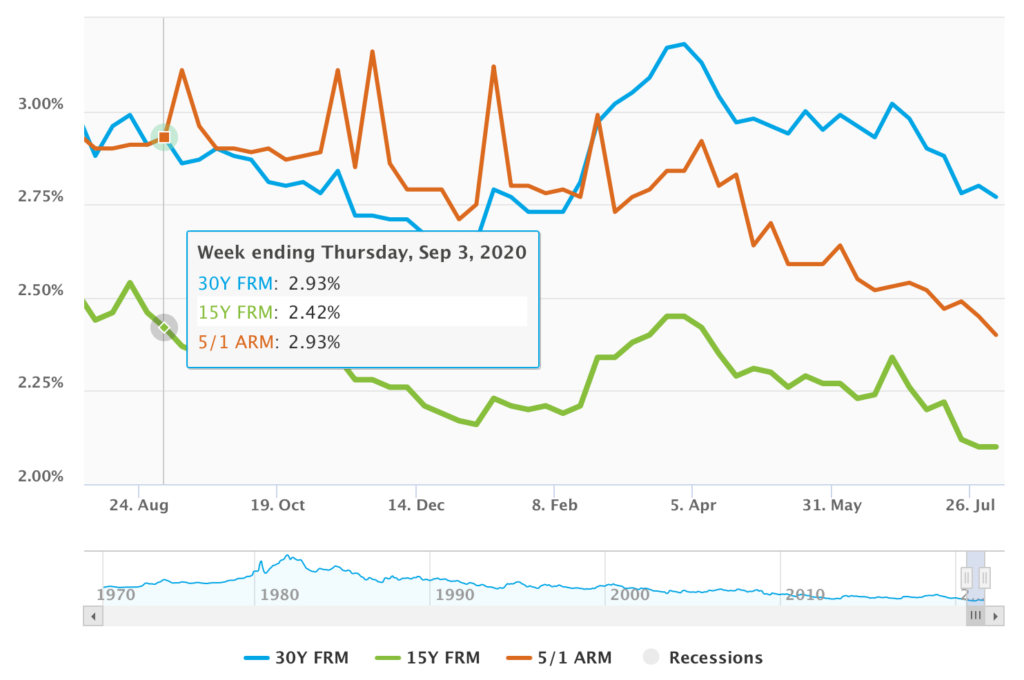

Today’s rates for August 18, 2021, the national average rate based on MND’s primary mortgage market survey for a 30-year fixed purchase or refinance mortgage is 2.96%, a slight increase of 0.01 from last week. The national average 15-year fixed mortgage or refinance rate is 2.41%, also a slight 0.01 increase over last week same period.

FHA 30-year fixed rate mortgage sits at a 2.68% national average, while Jumbo loans remain above the 3’s at 3.12% and 5/1 Yr ARMs, sitting at 2.54%, saw an increase for second week in a row.

*THIS IS NOT A DIRECT QUOTE FOR RATE. National averages reported for mortgage and refinance rates are from MND’s most recent survey of the primary mortgage market. Geneva Financial Home Loans mortgage and refinance rates are calculated at the close of the business day, and include annual percentage rates (APR) and/or annual percentage yields. Rate averages fluctuate throughout each business day, and are intended to help borrowers determine a baseline for rate conditions. Market averages are not a quote for rate for your specific financial scenario. Determining factors like credit scores and loan programs will impact individual quotes for today’s rates.

Learn the difference: Fixed VS Adjustable Rate Mortgage

Mortgage Rates and Fed Data August 18, 2021

Mortgage Rates Move Slightly Higher For Second Week – Nothing New With Fed

Mortgage rates are not on a stratospheric climb – not even close – but they have been on a slight uptick trend over the past 2 weeks. Today was more of the same despite a fairly positive reaction to the Fed Minutes.

What are Fed Minutes? The Fed Minutes offer a comprehensive overview of the talks that occur during the Fed policy meetings. These tend to be important events for financial markets – particularly the bond side of the market. If you were not already aware, bonds dictate interest rates, including those for mortgages.

The last Fed meeting was just 3 weeks ago, but traders have been antsy for any inclination about future Fed decisions. Trader anxiety reflected in the bond market, showing weakness ahead of the Minutes. Weaker bonds typically imply higher rates. The bond market corrected shortly following a mostly uneventful Fed reporting.

What was in the Fed Minutes? Not much new. Most information had already come to light in several Fed speeches over the last 3 weeks. The variable: Delta. A lot has changed in the past 3 weeks as the Delta variant of the COVID-19 has cause a resurgence of cases and a strained healthcare system. If the minutes had been less positibe, many mortgage lenders might have been in a position to give rates another bump higher this afternoon. As of right now we are not seeing any increase beyond the slight uptick at the start of trading today.

What does this actually mean for mortgage rates? The average mortgage lender in the United States is now essentially right in line with last week. Conventional 30yr fixed rates are near the 3% mark, depending on the borrower scenario. Rates continue to vary significantly between lenders.

Rent Payments in the News August 12, 2021

Federal Housing Finance Agency Announces Inclusion of Positive Rental Payment History

In a move meant to expand access to credit for American homebuyers, the Federal Housing Finance Agency (FHFA) announced that for Fannie Mae mortgage products, rental payment history will be considered in its risk assessment processes.

This update means future borrowers of conventional loans can have positive rental history included in the underwriting decision on their loan. Additionally, the agency announced there will be no further required steps – for the borrower or the mortgage lender – to take advantage of this new benefit.

Mortgage Rate News August 9, 2021

Rates Jump to 3 Week Highs

Home purchase and refinance interest rates were in an excellent position a week ago today. By Wednesday the market started to shift with reflective increases showing on Thursday and the positive reaction to Friday’s jobs report solidified higher rates Friday and today.

While rates have jumped to 3 week highs, they remain historically low. August of 2016 saw national averages on a 30-year fixed rate mortgage sitting at 3.55% – in January of 2020, just prior to COVID-19 triggering a massive rate drop, the 30-year FRM sat at a 3.7% national average. Today’s 2.94%, then, is still in the opportunity zone for most American homebuyers and homeowners looking to refinance.

Jobs Report in the News August 6, 2021

Market Reacts to Jobs Gains

Following a stronger than expected Jobs Report, markets responded in kind with the 10-year Treasury notching back up to 1.29%. Mortgage rates are expected to eek a little higher with the markets. Monday’s opening bell should reveal more of the impact.

August 2021 Jobs Report By the Numbers

The Bureau of Labor Statistics (BLS) reported 943,000 jobs created in July – well above the 870,000 projection. Unemployment also outperformed projections with a drop to 5.4% VS the projected 5.7% we reported yesterday. Average hourly earnings were up 0.4% over previous report and 4% over the same period last year. Revisions to May and June reporting were also positive, adding to investor confidence.

Today’s Rates in the News August 5, 2021

Mortgage Rates Slide

10-year treasury yields dropped today opening at a low 1.19% yield in reaction to global market uncertainty surrounding the Delta variant of COVIS-19. Mortgage rates subsequently followed suit with the 30-year fixed-rate mortgage dropping to early 2021 lows. The 15-year fixed remains at its historic low. Today’s rates continue to favor Americans looking to refinance, renovate, take cash-out or purchase a new home.

How Will August Jobs Report Impact Rates?

Stocks remained high today and Mortgage Bonds continued to move lower as the day opened, but what will happen to rates after tomorrow’s Jobs Report? Initial jobless claims and continuing jobs claims were both down last week and dipped below 3M for the first time post-pandemic. Individuals still receiving benefits across all programs were down 181k.

Last Jobs Report: 850k job creations and 5.9% unemployment rate

Estimated ahead of tomorrow’s report: 870k job creations and 5.7% unemployment rate

While estimates are an improvement over previous report, job creation numbers are still half of what was expected. A weaker than expected jobs report should push the 10-year yield lower, which should result in a subsequent dip in mortgage rates.

Reasons to Refinance Your Mortgage and Picking a Refinance Lender

Mortgage refinancing is done for many different reasons. From lowering your monthly payment by reducing your interest rate, to lowering your term, to taking cash out of your home to even switching loan types, there are many reasons that a borrower may want to look into a mortgage refinance. Most people don’t realize that their home is an important financial tool to utilize as an investment for their future. It is always good to remember that you have the opportunity to refinance your mortgage even though it may not be something that you would typically readily consider. The above 4 scenarios are all beneficial to homeowners at one point or another in their lives. Even though most people take out a 30 year mortgage it is extremely uncommon for individuals to stay in the same mortgage for the full 30 year duration that they took out their original mortgage.

Interest rates go up and down and while a homeowner may not typically think that they could benefit from a refinance in the first few years after purchasing their homes we have found that to be quite the opposite with the market as it currently is with interest rates in the high twos and low threes. If you have an interest rate over 4.5, which you could have if you purchased within the last two years it may make a world of difference to look into a refinance simply to lower your total monthly mortgage payment by reducing your interest rate. A savings of $100 a month may not seem like a lot of money but over 30 years that is the savings of $36,000.

Lowering the term of a mortgage also is not something that is typically thought of as making a huge difference in the grand scheme of things but again every little bit adds up. A lot of folks are familiar with 30 and 15 year mortgages but what they may not know is that custom amortizations are available in many cases as well. You can go from a 30 year to a 25 a 20 a 15 or even a 10 year mortgage in many instances. While your monthly payment may go up slightly to go to a lower amortization or may not even change at all again looking at the bigger picture the savings are readily apparent. One scenario I ran across just this week had a set of borrowers that had purchased their home in 2009 interest rates at that time were around 6% they initially had thought that they did not want to refinance because they did not want to reset their term and they did not know that shorter terms were available. Their monthly payment had been $1200 per month their new payment ended up to be $1222.28 per month. Even though they went up $22.28 per month they cut three years off of their remaining mortgage. The monthly savings of $1200 over that three year period amounted to nearly $43,000 in total savings.

Taking cash out of your mortgage can be an excellent way to pay off higher interest liabilities such as credit cards and student loans. Oftentimes credit cards have interest rates that are over 20% and student loans can also carry extremely high interest rates as well. By taking cash out of the mortgage and utilizing the equity that has been built up in the mortgage you will pay off your debts and save a lot of money on interest in the long run, not to mention you will increase your monthly residual income by decreasing your monthly obligations.

Finally, changing your mortgage product might be something that you would consider if you initially purchased your home as an FHA loan. With the latest installment of rules with FHA the PMI (private mortgage insurance) that is associated with an FHA mortgage is not able to be removed from the mortgage even once you have more than 20% equity in your home> Currently, the only way to eliminate FHA private mortgage insurance is to refinance out of the FHA loan and to get into a conventional mortgage product. With some homes in the country going up in value as much as 40% in the past year an individual that purchased their home using an FHA mortgage within the past year would easily be able to take advantage of the still low interest rates and remove the private mortgage insurance that they are paying monthly. Again you don’t have to have been a homeowner for even a full year before looking into a refinance that might potentially make sense.

The best way to find a mortgage lender to help you with a refinance is to first of all speak with friends and family about their past experiences and try to find someone that is local in your area. Oftentimes using a national chain such as one that you would see in a commercial on television can be daunting. It is not to say that these companies are not legitimate or do not do good loans but a mortgage professional is only as good as their experience and oftentimes companies that have big advertisements on television hire new loan officers that don’t necessarily know the in’s and the out of all different loan products. Try to find a mortgage professional that is local in your area and has been in business for at least a number of years. Do not be afraid to shop around either to get the most equitable refinance opportunity for yourself in your situation. It is very important that the mortgage professional that you end up choosing is someone that you feel you can trust. Be sure that you communicate with them all of your financial needs and hopes with the refinance so that they can find the best product for you.

FIND A LICENSED MORTGAGE LOAN OFFICER