Geneva Financial is excited to announce that we are now accepting credit scores as low as 580 on FHA Mortgage Loans.

Previously FHA Loans required a minimum credit score of at least 600 or higher, We are now accepting credit scores as low as 580!

What does this mean?

We can now serve an even wider range of humans to finance the home of their dreams! Your dreams of homeownership may be easier to achieve than you think!

Let’s Dive Into FHA Loans:

What is an FHA Loan?

An FHA Loan is a mortgage that’s insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and are especially popular with first-time homebuyers. These loans are designed for low to moderate income borrowers.

FHA Loan

What are the requirements of an FHA Loan?

- FICO® score at least 580

- 3.5% down payment.

- MIP (Mortgage Insurance Premium) is required.

- Debt-to-Income Ratio < 43%.

- The home must be the borrower’s primary residence.

- Borrower must have steady income and proof of employment.

Read more about FHA Home Loans HERE

Who can qualify for an FHA Loan?

FHA loans are often a popular choice for a first-time homebuyer. FHA loans require a lesser deposit than a conventional loan and can help keep costs low when purchasing a home. They may also require a lower credit score in comparison to other loans.

What downpayment is required for an FHA Loan?

For FHA, down payments can be as low as 3.5%, this is typically reserved for borrowers with a higher credit score. A downpayment as high as 10% might be required for those with a lower credit score.

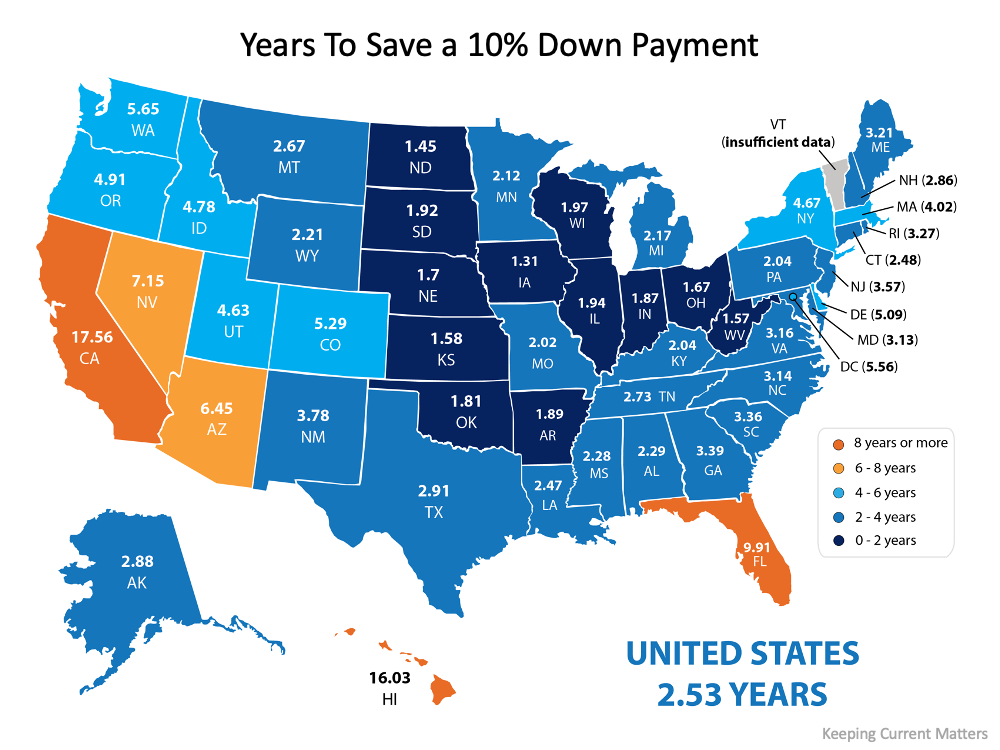

Saving for a downpayment may not actually take as long as you think. According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

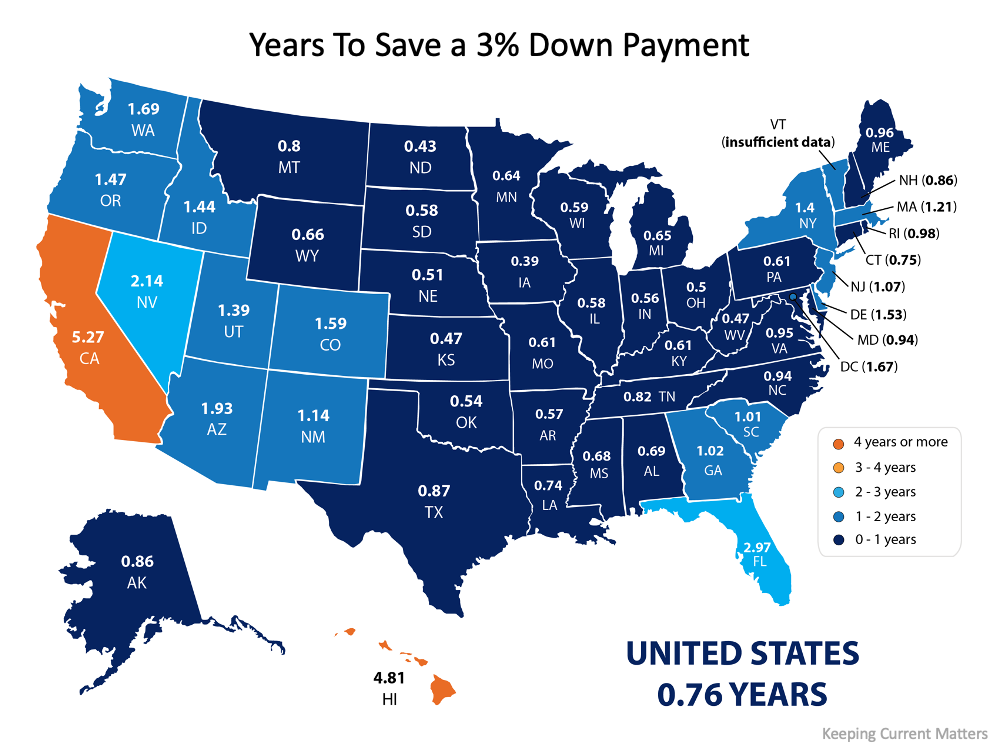

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

What loan terms are available for an FHA Loan?

There is a variety of loan terms available when obtaining a mortgage. The most popular is a 30-year mortgage. Another option is a 15-year mortgage. The difference between the two is the length of the loan. A 15 year will be paid off in 15 years, typically these come with a lower interest rate, due to the length the borrower often pays significantly less in interest over time. A 15-year mortgage however will come with a higher payment than a 30-year loan.

Curious to see what your home payment would look like?

HOME PAYMENT CALCULATOR

Get in touch with YOUR loan officer today. To find a loan officer click HERE