Home>>Mortgage News>> More Jobs and Better Pay Leads to More Buyer Demand

There’s been talk about a recession for quite a while now. But the economy has been remarkably resilient. Why? One reason is employment and wages have stayed strong. Let’s look at the latest information on each one and why both are good news if you’re thinking about selling your house.

More Jobs Are Being Created

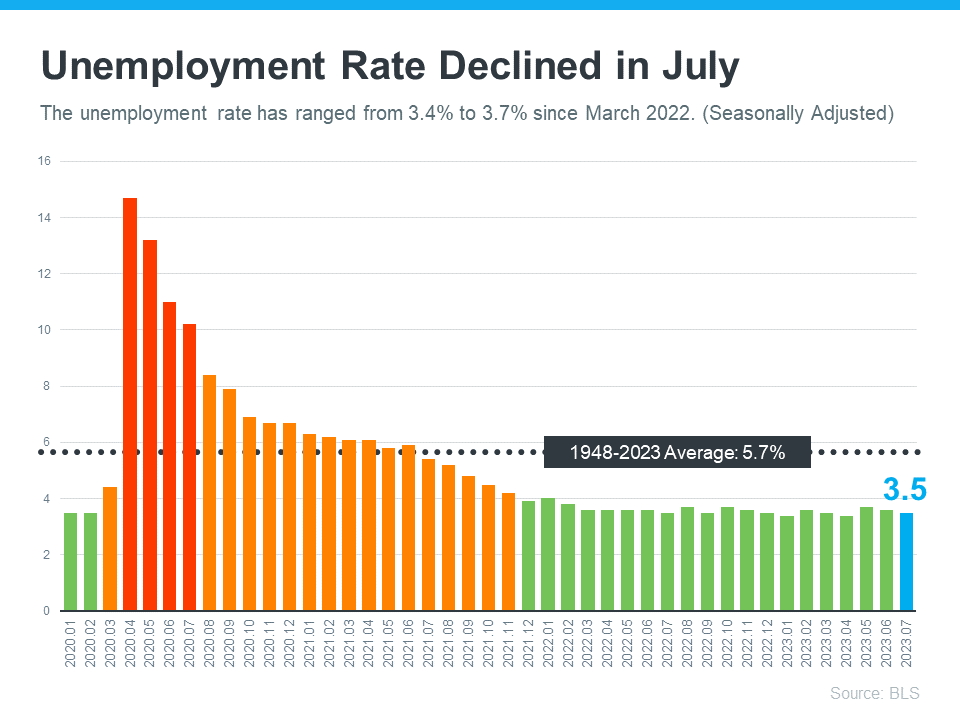

Instead of facing the job losses typical of any recession, the economy has been growing and adding jobs. According to the Bureau of Labor Statistics (BLS), 187,000 jobs were created in July, which is up from the 185,000 created in June. That means more people are finding work. In fact, so many jobs are being added that the unemployment rate is far lower than the long-term average of 5.7% (see graph below):

A low unemployment rate means that most people who want to work are finding jobs. When people have jobs, they have steady incomes – and that can help set them up to consider homeownership.

People Are Making More Money

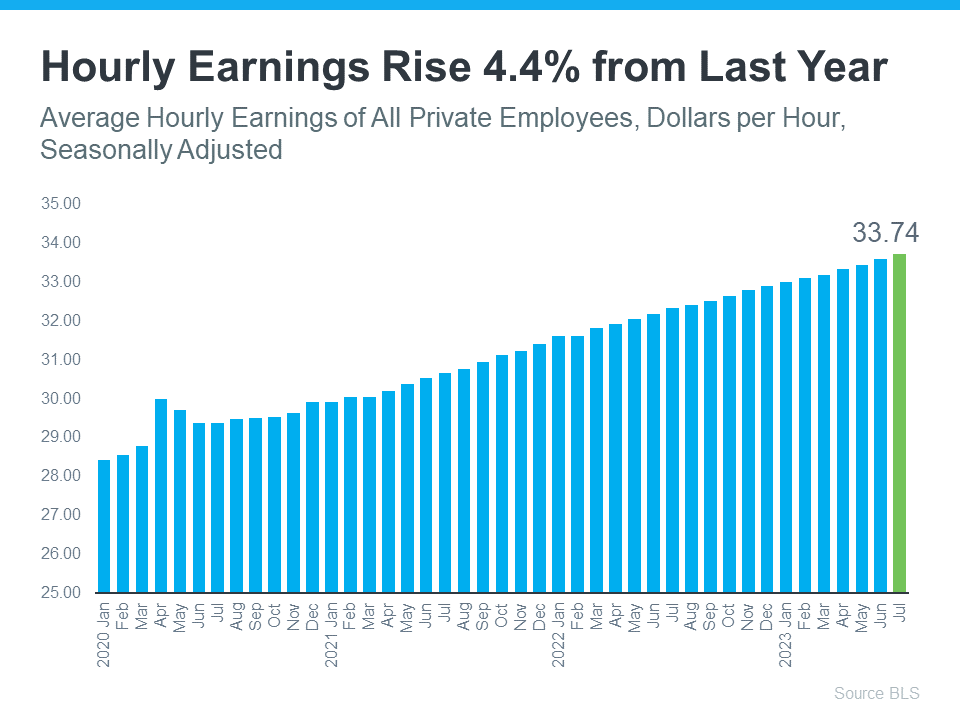

Data also shows hourly earnings have been going up pretty steadily over the past few years (see graph below):

When wages rise, people have more money that they could save or use toward buying a home. This increase in income helps offset some of the affordability challenges in the housing market today. Affordability depends on three main factors: wages, home prices, and mortgage rates. With higher home prices and mortgage rates right now, Builder Online summarizes how growing wages can help:

“The housing market has been a beneficiary of the strong economy and labor market. Many of those employed have saved money over the past few years and used those funds toward a down payment on a home.”

If you’re thinking about selling your house, a strong job market, growing wages, and the resulting buyer demand is fantastic news. It means there’s a larger pool of potential buyers out there who are in a position to pursue their dreams of homeownership.

Bottom Line

With more jobs and rising wages creating eager buyers, there’s a lot going in your favor. Connect with a local Mortgage Loan Officer who can guide you through the process of selling your house, from setting the right price to getting your home ready to show.

Curious to see what your loan payment could look like? Try our interactive mortgage calculator below:

House Payment Calculator:

FIND A LICENSED MORTGAGE LOAN OFFICER