Mortgage News>> Market Update June 2021

100% FHA FINANCING FOR FIRST RESPONDERS & EDUCATORS

The Homes for Every Local Protector Educator and Responder Act is a new bill that has been introduced that would allow first responders and educators access to 100% financing through the Federal Housing Administration. The program would be very similar to 100% financing offered through Veterans Affairs for vets. Like VA loans, the 100% financing would come with a 3.6% up-front mortgage insurance, which could be financed, but no monthly mortgage insurance. Police officers, prison guards, firefighters, paramedics, emergency medical technicians, and public or private school teachers would all be eligible. The borrower would have to have worked in that line of work for the past four years to qualify for this program.

The mortgage industry would salivate over this program if the bill were to pass, as it would expand the number of borrowers that could be approved for a new home loan. Although today, the program would simply increase demand for an already limited supply of housing. There is also a correlation between down payment and default rates. Would first responders’ and educators’ loans to 100% perform as well as VA loans do? The industry just may get the opportunity to find out.

PAY TO PLAY

A new Confidence Index Survey from the National Association of Realtors (NAR) states that the average home sold had at least five offers, and 50% sold for more than the list price. Which means in many cases, the home sold for more than the appraised value. If you are not a cash buyer (currently 25% of home sales), this can create additional stress for homebuyers, especially first-time home buyers.

Traditional financing will base the loan amount off the list price or appraised value; whichever is lower. Those willing to waive appraisal contingencies, will often have to bridge the gap between the offer price and appraised value. If you do not have additional assets, sometimes in the tens of thousands of dollars, above and beyond your anticipated down payment and closing costs, be very cautious of waiving appraisal contingencies. In today’s market, a high percentage of real estate agents will not write a contract with an appraisal contingency, knowing that the home will likely sell over appraised value.

The housing market is hot, but there are signs it may be cooling. Pending sales ticked down 10% for the last seven-day period ending May 16th, and mortgage purchase applications dropped 4%. Do not get your hopes up. Inventory is still down 40% year over year, and cost of construction costs are through the roof. Demand is unprecedently high. Although the current pace of appreciation is unsustainable, there is no clear end in sight. Baring a sharp uptick of interest rates to counter inflation, the housing market will continue to create economic barriers to entry for homebuyers and create fortunes for sellers, for the foreseeable future.

ALL TIME RECORD HIGH HOME PRICES

A recent study from Redfin stated the national median home price reached $370,528 for the month of April. That marks a 22% increase in just one year, setting a new record for appreciation and price.

“There simply aren’t enough homes for sale in America for everyone with the desire and the means to buy one right now,” Chief Economist Daryl Fairweather said. “Until new construction takes off — over the course of years, not months — home prices will continue to increase. This housing boom is nowhere close to over.”

“To put the scarcity of housing into context, there is plenty of room for supply to increase and demand to taper off, and we would still find ourselves in a historically strong seller’s market,” Fairweather said. – housingwire.com

Rising home prices are forcing many out of their city and state. But with California dominating in appreciation and home sales, do not believe that everyone is moving out of CA.

The largest gains in sales were in places that had the most abrupt slowdown of home sales in April 2020, including San Francisco (up 184%) and San Jose, California (up 150%) and Miami, Florida (up 120%). Median home prices increased from a year earlier in all of the 85 largest metro areas Redfin tracks. The smallest increase was in Honolulu, Hawaii, where prices went up 0.2% from a year ago. The largest home price increases were in Austin, (up 42%), Oxnard, California (up 26%) and Miami (+26%). – housingwire.com

The most expensive real estate just keeps getting more expensive. It seems the rich are not going anywhere.

SECOND HOME DEMAND SOARING

It is hard enough to buy a primary residence, but second home demand has also soared. In April there was a 178% increase in the number of people who locked a mortgage for the purchase of a second home. It was also the 11th straight month of 80% plus growth according to a new Redfin study. – housingwire.com

“The combination of the wealthy becoming wealthier, remote work turning into the new normal and low mortgage rates is creating an ideal environment for affluent Americans to buy vacation homes,” Redfin Chief Economist Fairweather said. “As long as the economy continues to grow, I don’t foresee demand for second homes slowing down anytime soon.”

This is a by-product of the pandemic. The demand for second homes is outpacing the demand for primary residences more than 2 to 1. The pandemic had a much greater negative financial impact on lower-income households than those who are more affluent. The wealthy, just got richer, allowing them to capitalize on historically low-interest rates and purchase 2nd homes and vacation homes.

When looking at the largest markets in the U.S., the biggest increase in luxury-home sales in the first quarter of 2021 was Miami, with sales up 101.1% from a year earlier. Miami was followed by San Jose (up 92.3%), Oakland (up 82%), and Sacramento, California (up 79.3%) and Las Vegas (up 72.7%). – housingwire.com

Not only are the wealthy purchasing more second homes, but there are also more vacation homes to choose from. Luxury home sales have only fallen 5.1% from a year ago. Affordable homes for sale dropped nearly 15% over the same period.

LOW INCOME REFINANCE OPTIONS

Fannie Mae’s RefiNow will be available June 5th, and Freddie Mac’s Refi Possible will be available sometime in August. Both programs designed to help low-income borrowers take advantage of historic low-interest rates.

To qualify, the borrowers must save at least $50 per month, and lower their interest rate by 50 BPS. The borrowers will also receive a $500 credit for the appraisal, when an appraisal is required. Fannie and Freddie will also waive the 50 BPS adverse market fee, a fee implemented on all refinances in 2020, for loan amounts less than $300,000.

Additional Requirements:

- Income at or below 80% of the area’s median income.

- Current on their last six payments with no more than one late in the last twelve months.

- Debt to income no higher than 65%.

- Minimum credit score of 620.

- Loan to Value no higher than 97%.

HOMEBUILDER CONFIDENCE

Remains unchanged in May. The market is hot, and that is not going to change anytime soon. Demand is high and inventory is low.

With soaring construction costs, it may take government intervention to reduce costs of construction. Tariffs implemented by the previous administration sent many goods for construction skyrocketing. That has been further compounded by disrupted supply chains due to the pandemic, and massive demand. Suspending tariffs on the imports of construction materials may get prices moving the right direction.

Lumber alone has tripled over the last 12 months. Steel also substantially higher. The framing lumber costs at the beginning of May was approximately $1,500 per thousand board feet. In April of 2020 it was $350 per thousand board feet. Next to impossible to build affordable housing at those costs.

FOREBEARANCE OUTLOOK

The total number of home loans in forbearance continues to slowly click downward. According to a new report from the Mortgage Bankers Association, loans in forbearance dropped to 4.22%, down three basis points. A small move in the right direction.

The numbers of loans past due are still at alarmingly high levels. A report from Black Knight states that 1.8 million loans are at least 90 days past due. That is four times higher than pre-pandemic times.

Fannie Mae and Freddie Mac continued to boast the smallest share of loans in forbearance, down three basis points last week to 2.21% of their portfolio volume. Ginnie Mae loans also fell two basis points to 5.59%, while the forbearance share for portfolio loans and private-label securities (PLS) remained the same relative to the prior week at 8.26%.

“Although the overall share is declining, there was another increase in forbearance re-entries. Currently, 5.3% of loans in forbearance are homeowners who had cancelled forbearance but needed assistance again,” said Mike Fratantoni, MBA’s senior vice president and chief economist. – housingwire.com

The government is banking on the economy recovering with the vaccine in short order, bringing back so many jobs lost due to the pandemic, allowing people to come out of forbearance. If that does not happen in a timely fashion, the government will have to keep writing checks to pay peoples mortgages, or foreclosures are going to spike. A not-so-subtle way to bring inventory to market.

U.S. NATIONAL DEBT & WEED

For the first quarter of 2021, the U.S. national debt hit an all time high, growing $1.7 trillion, up 130%, in a single quarter.

The U.S. now stands at $28.328 Trillion and climbing.

While not popular with all demographics, the legalization of marijuana is a progressive movement that will inevitably cause laws to change at the Federal level. Marijuana is now legal or decriminalized in all but 6 states. 17 states and Washington D.C. have completely legalized recreational use and are printing tax revenue. Maybe the Feds should get with the times and instead of cutting social programs or taxing corporations to death, just legalize weed and tax it. Like housing, the demand is high (no pun intended).

GENEVA FINANCIAL, LLC NOW LICENSED IN 45 STATES

Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., West Virginia, Wisconsin, Wyoming

Pending: North Dakota

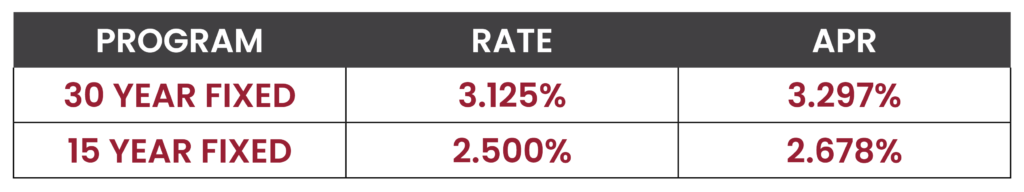

RATE WATCH – LOWER

Interest rates as of 05/26/2021. Conforming interest rates. Interest rates and APR based on loan amounts not to exceed $548,250. Loan to value not to exceed 80%. 740+ credit score. Owner-occupied only. Purchase and rate in term refinances. Not all applicants will qualify. Call today for your individual scenario rate quote.