Mortgage News>> Market Update August 2022

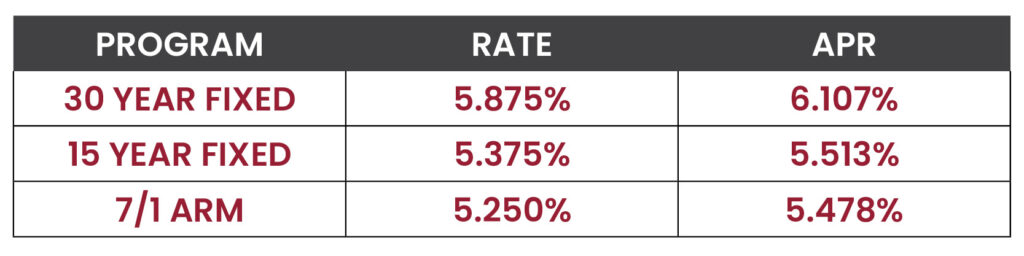

Check Today’s Rates for Mortgage and Refinance

FED WATCH

To squash inflation, the Fed is anticipated to raise short-term rates by 75 BPS, with a slight chance of 100 BPS increase on Wednesday. The market was surprised earlier this month when the CPI (Consumer Price Index) rose month over month to 9.1%.

NEW HOME SALES – JUNE 2022

New home sales were down 8.1% in June; 40% off the peak. 590,000 versus the 660,000 that was expected. Currently, new home sales inventory is up to 9.3 months due to a large supply of new home builds coming online, with weak buyer demand. Another strong sign is that the housing market is in correction.

GOVERNMENT MORTGAGE DELINQUENCY TICKS UP

A strong economy and rapid home appreciation generally result in low mortgage delinquencies. Times are changing. The US economy is either in a recession, or likely headed into one, home values are starting to plateau, and delinquencies on government home loans are starting to rise.

For the first time in seven quarters, delinquency rates increased to 6.76% on FHA-backed home loans and 3.37% on VA-backed home loans. – IMF news

The national mortgage delinquency rate rose in June after hitting consecutive record lows in each of the previous three months.

The overall delinquency rate rose nine basis points to 2.84% in June, according to Black Knight. The delinquency rate is 35% lower than the same period last year and remains 30% below pre-pandemic levels.

A total of 1.51 million properties were in early-stage delinquencies, defined as borrowers who missed a single mortgage payment, which is a 5% increase from May. – Housingwire

Mortgage delinquencies and foreclosures, while experiencing an uptick, are expected to stay low barring a major correction in the US economy.

DEPRECIATION = HEALTHY HOUSING

Inflation, inflation, inflation. The number one topic in 2022. A new financial pandemic that once again plagues most of the world’s economies, including the United States. In July, the Consumer Price Index hit 9.1% causing grave concerns in the markets, and increasing the Fed’s motivation to radically raise interest rates to stomp inflation out.

The Federal government poured over $6 trillion into the US economy to counter the negative economic effects of the COVID pandemic. US debt soared. The Treasury printed debt at an unprecedented pace, and the Fed purchased that debt. The US government is now the largest holder of US debt. These policies did prevent an economic depression, and one of the quickest recessions in history. Interest rates plummeted to historic lows, fueling spending, and sending home prices to historic highs. The outcome is an overheated economy, and inflation runs wild. A stimulated and socialize economy.

While everyone complains about rising fuel, food, and household prices, homeowners never complain about rising equity in their homes. Housing is a commodity, and not somehow a protected class. If inflation needs to pull back, then home values have to pull back, at least if we are to get to a “healthy” state in the overall economy. Through the first 2 years of the pandemic, U.S. home prices soared by 38.5%. In Phoenix, home prices grew by more than 50%, not sustainable and certainly not healthy. To curb inflation, home pricing must also pull back. Inflation is inflation. To suppress the rising prices that consumers pay for products, you must lower prices across all classes, including housing. The Fed intends to do that.

In 2021, home values had an increase in equity that exceeded the median US income.

Zillow Group Inc.’s home value index, which estimates the value of the typical U.S. home, rose 19.6% in 2021 to $321,634, an increase of $52,667 from 2020. That figure was slightly higher than what the median U.S. full-time worker earned, which was about $50,000 last year before taxes, according to Census Bureau data cited by Zillow.

That marked the first time that the annual nationwide dollar growth for the typical home value exceeded the inflation-adjusted median pretax income, according to a Zillow analysis, which goes back to 2000. -Masion Global

There are signs of weakness in the housing market, which could prove to be an overall good thing for housing. According to the National Association of Realtors (NAR), existing home sales fell for the fifth consecutive month, falling 5.4% in June over May; and 14.2% year over year. Yet, home prices continued to climb 13.4% year over year, hitting a record of $416,000 for the median home price.

When sales fall, so should prices. Mortgage applications just hit a 20-year low. Purchase applications are down over 40% from the 2020 peak. Freddie Mac deputy chief economist Len Kiefer tweeted that the downward shift in mortgage applications means “the U.S. housing market is at the beginning stages of the most significant contraction in activity since 2006.” That means fewer people trying to qualify for homes. This is a product of mortgage interest rates climbing nearly 3% this year; the most aggressive rise of long-term rates since 1981. There is also a lot of uncertainty in the market, landing many prospective homebuyers on the sidelines. The 20%+ decline in the stock market has also taken its toll on higher-income borrowers’ net worth; leading to more bearish spending.

Homebuilders are also reacting to the market swing. While some cost of construction metrics have lowered, homebuilders are hesitant to build homes at rising rates and a potential recession. Demand is plummeting and market timing is critical when bringing new homes to market.

“Housing is an interest rate sensitive sector. As mortgage rates rose over the past couple of months, we saw buyers pull back in response to the higher housing costs,” wrote Ali Wolf, chief economist for housing data firm Zonda, in a Friday email.

“Many pundits emphasize home price levels, but ultimately, people buy homes based on the monthly payment. Rising home prices combined with higher mortgage rates are driving up the monthly mortgage payment, which is impacting housing affordability,” she wrote.

Wolf said 11 percent of U.S. homebuilders slashed their prices in June from May, according to Zonda data, to help keep up sales. Home sale cancellations also jumped to 14.9 percent in June, according to brokerage firm Redfin, the highest rate since the start of the COVID-19 pandemic. – The Hill

Homebuilder sentiment in July plummeted by 12 points according to the National Association of Home Builders. Except for April 2020 (pandemic), it was the largest drop in 37 years. – CNBC

Construction costs are still elevated, and skyrocketing interest rates have created an affordability issue. Many builders have more than doubled buyer incentives in recent months to help prospects financially and mentally commit today. Demand may further wane if the economy losses stream due to a recession.

Inventory is up and rising. June posted an increase of 9.6% from May and 2.4% year over year. Inventory is now at a 3-month supply; about half of where it needs to be for a “healthy” market. Rising inventory will also lead to falling prices. In May, nearly 20% of all home sellers dropped the price of the home.

In June the Fed owned a staggering $2.7 billion in mortgage-backed securities; and started to unwind that position. The aggressive unwinding of this position puts a lot of upward pressure on mortgage rates. That is the Fed’s intent. Rising rates will put downward pressure on housing demand, which should translate to lower home values. Not something that homeowners want to hear, but a positive for the overall long-term health of the housing market.

This is not a repeat of 2008. Dodd-Frank regulation has largely prevented high-risk mortgages from being originated over the past 14 years. Had it not been for heavy-handed regulation, 2022 could make 2008 look like a walk in the park. Adjustable-rate mortgages (ARMs) make up just 16% of all mortgages today, whereas in 2008 they made up nearly 40% of all mortgages. There is nothing inherently dangerous about ARMs today, but in the sub-prime mortgage era, ARMs could adjust higher, regardless of short-term rates at the time of the adjustment, and people could not refinance out when equity plummeted. Today, ARMs may be one of the very best options for a prospective homebuyer, and a homeowner wishing to tap equity. No, this is not a repeat of 2008, but that does not mean values will not fall. Today, values must fall if we are to have a healthily housing market once again.

The economy and housing have, and will always, ebb and flow in cycles. A recession can be just a healthy reset of the economy. This may feel more severe due to the radical nature of rate increases, the volatility of the stock market, and the inevitable drop in home prices, but that is solely contributed to the extreme highs the economy is coming off. During a global pandemic 2020/2021, the stock market hit historic highs, as did the housing market; a residual effect of a $6 trillion government spending spree. The Fed is now trying to normalize inflation, including that of housing, we will likely experience a pullback in fuel prices, stock prices, and home prices. Hard to get one without the other. The Federal Reserve anticipates cutting rates in 2024. There are many market insiders that believe it will likely come sooner, especially if the Fed does not navigate a “soft” economic landing.

Looking forward, once the Fed stomps out inflation and potentially sends the economy into recession, they will reach into their arsenal to reverse course. This will once again include the purchase of mortgage back securities and cutting the Fed Funds rate. Mortgage rates will fall, all the mortgages originated in the last couple/few years will refinance, and housing demand will soar. Homebuilders will frantically try to restart construction to supply demand, and inventory will sink. Home values will rise. Homeowners will be real estate rich once again, at least on paper. The cycle will reset.

Like many other problems that plague the US, as the country completes this cycle once again, we will still be left with a problem yet unsolved. Today, and tomorrow, there will not be a shortage of homes. The US birth rate and population growth through migration are plummeting. Today there is a simple shortage of homes for sale. The most pressing issue today, and tomorrow, is the shortage of homes for sale and housing in general, for the lower-income classes. The class that rarely benefits from boom cycles, but always takes, yet another hit during bust cycles. Over the last couple of years, the cost of construction skyrocketed, and today interest rates have compounded the problem. Yet, the problem still exists and will need to be addressed to have a “healthy” market, maybe for the first time in a long time.

U.S. NATIONAL DEBT

The U.S. now stands at $30.6 trillion and climbing. To put that into perspective, the entire U.S. GDP in 2020 was $20.93 trillion.

GENEVA FINANCIAL, LLC NOW LICENSED IN 46 STATES

Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., West Virginia, Wisconsin, Wyoming

Pending: Alaska

Rate Watch – Higher

APPLY ONLINE: www.genevafi.com

Interest rates as of 07/26/2022. Conforming interest rates. Interest rates and APR based on loan amounts not to exceed $647,200. Loan to value not to exceed 80%. 740+ credit score. Owner occupied only. Purchase and rate in term refinance. Not all applicants will qualify. Call today for your individual scenario rate quote.