Check Today’s Rates for Mortgage and Refinance

REFINANCE BOOM COMES TO AN END

The U.S. economy is hot and appears to be heating up. As the vaccine gets administered to millions and businesses start to reopen and return to pre-pandemic production, the economy has been on fire. And with a booming economy, interest rates will rise, only this go around, they have unexpectantly spiked.

Most economists and mortgage industry insiders anticipated a rising interest rate market in 2021. Very few expected it to come so soon, and so ferociously. Sub 2% mortgage rates? Forget about it. Most long-term rates have moved nearly 0.5% in the last few weeks, and there is little evidence that they are going back down. Sub 3% rates is now one of the few positive memories of 2020.

Strong Economy = Rising Interest Rates. You do not get to have it both ways. Interest rates crashed to historic lows in 2020 due to a severe recession brought on by the pandemic. Not even through the first quarter of 2021, the economy seems to be on a fast track to recovery.

“Rates have jumped 36 basis points since the end of January, and last week refinance activity fell across all loan types,” said Joel Kan, the MBA’s associate vice president of industry surveys. “The purchase market helped offset the slump in refinances. Activity was up 5 percent from a year ago, as the recovering job market and demographic factors drive demand, despite ongoing supply and affordability constraints.” – housingwire.com

Data from ICE Mortgage Technology (parent company of Ellie Mae) on February loan closings:

- Average Credit Score: 753

- Average Loan to Value: 70%

- Average Debt to Income: 23/34

HOME PRICES HIT ALL TIME HIGH

According to a new report from Redfin, the median home price hit an all-time high of $331,590. That is up 16% over last year. The average home price hit an all-time high of $416,000, up $65,000 over the previous year.

During a four-week period ending March 21 and covering 400 metros, 58% of homes that went under contract had an accepted offer within the first two weeks on the market. And between March 14 and March 21, 61% of homes sold in that timeframe had been on the market two weeks or less, and 48% had sold in one week or less.

And offers are coming in well-above asking price, too. Nearly 40% of homes sold above their list price – another all-time high – and 15 percentage points higher year-over-year. The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased to 100.2%. – housingwire.com

Signs of a housing bubble? Not likely. Too much demand and not enough inventory. The price of homes will continue to rise for the foreseeable future, barring an unforeseen change in the overall economy. Too little inventory. Rising interest rates. Soaring construction costs. There will be a peak, as rapid appreciation is unsustainable. Once construction costs fall, builders will be able to start building affordable housing once again. Today, it is just a question of time.

FED STILL HUNGRY FOR BONDS

To drive interest rates lower, the Fed has been consuming bonds at an unprecedented rate, with no end in sight. In the fourth quarter of 2020, the Fed purchased $77.6 billion of Agency Mortgage-Backed Securities (MBS). Already in 2021, they have added $94.0 billion. Today, the Fed’s holdings of MBSs are a staggering $2.133 trillion. Foreign investors hold approximately $1.29 trillion. – Inside Mortgage Finance Publications.

NEW HOME SALES TANK

New home sales peaked to a nearly ten year high in January, only to tank in February; down 18.2%. According to HUD, that is the largest month over month declined since 2013.

Economics credit the plummeting numbers to rising interest rates, a spike in construction costs, and lack of inventory. Lumber prices alone jumped 59%.

EXISTING HOMES SALES UNDER PRESSURE

Existing home sales did not great crushed as bad as new home sales did in February, but they were also well off their recent highs. Month over month existing home sales dropped 6.6%,

“Despite the drop in home sales for February – which I would attribute to historically-low inventory – the market is still outperforming pre-pandemic levels,” said NAR chief economist Lawrence Yun. “Home affordability is weakening. Various stimulus packages are expected, and they will indeed help, but an increase in inventory is the best way to address surging home costs.”

First-time homebuyers accounted for 31% of sales, down from 33% in January and 32% in February 2020. Individual investors or second-home buyers acquired 17% of homes, up 15% month over month and unchanged from the year before. All-cash sales made up 22% of transactions, up 19% month over month, and 20% year over year. Distressed sales (foreclosures and short sales) stayed the same at less than 1%. – Mortgage Professional America

Lack of inventory and rapidly rising interested rates are deemed mostly responsible for the drop of existing home sales.

HOME PRICES SOAR

The recent Case-Shiller report, home prices in December posted a 10.4% annual gain. Phoenix posted the greatest gains at 14.4%. Seattle posted 13.6%, and San Diego was up 13.0%.

GSEs PRINTING MONEY

The 2020 financial results are in for the GSEs, and their profits are high. Fannie Mae posted a net income of $11.8 billion. Freddie Mac posted a net income of $7.3 billion.

FAIR HOUSING ACT TO EXPAND PROHIBITIONS

It took until the year 2021 for the United States to ban housing discrimination based on gender identity or sexual orientation. Executive Order (13988) signed by President Biden gives housing freedom to citizens of the United States regardless of gender identity or sexual orientation.

HUD offices and recipients of HUD funds will enforce the policy immediately, said Jeanine Worden, acting assistant secretary of HUD’s Office of Fair Housing and Equal Opportunity. “Housing discrimination on the basis of sexual orientation and gender identity demands urgent enforcement action,” Worden said. “Every person should be able to secure a roof over their head free from discrimination, and the action we are taking today will move us closer to that goal.”

Per the memorandum:

HUD will accept and investigate all jurisdictional complaints of sex discrimination, including discrimination because of gender identity or sexual orientation, and enforce the Fair Housing Act where it finds such discrimination occurred. HUD will conduct all activities involving the application, interpretation, and enforcement of the Fair Housing Act’s prohibition on sex discrimination consistent with its conclusion that such discrimination includes discrimination because of sexual orientation and gender identity.

State and local jurisdictions funded by HUD’s Fair Housing Assistance Program (FHAP) that enforce the Fair Housing Act through their HUD-certified substantially equivalent laws will be required to administer those laws to prohibit discrimination because of gender identity and sexual orientation Organizations and agencies that receive grants through the Department’s Fair Housing Initiative Program (FHIP) must carry out their funded activities to also prevent and combat discrimination because of sexual orientation and gender identity.

U.S. NATIONAL DEBT

$28.08 Trillion and climbing.

GENEVA FINANCIAL, LLC NOW LICENSED IN 44 STATES

Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., Wisconsin, Wyoming

Pending: North Dakota, West Virginia

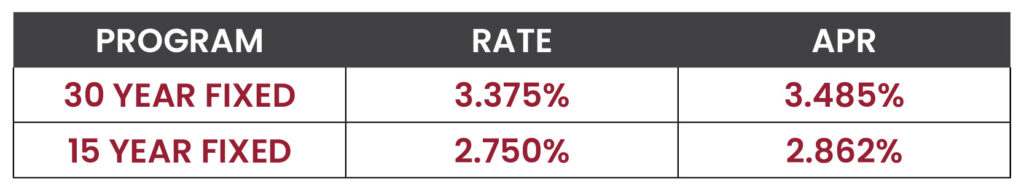

RATE WATCH – HIGHER

Interest rates as of 03/29/2021. Conforming interest rates. Interest rates and APR based on loan amounts not to exceed $548,250. Loan to value not to exceed 80%. 740+ credit score. Owner occupied only. Purchase and rate in term refinances. Not all applicants will qualify. Call today for your individual scenario rate quote.