Home>>How Much Down Payment Is Needed To Buy A Home

How Much Down Payment is Needed for a Home and How Long Does It Take To Save Up?

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

Using data from the U.S. Department of Housing and Urban Development (HUD) and Apartment List, we can estimate how long it might take someone earning the median income and paying the median rent to save up for a down payment on a median-priced home. Since saving for a down payment can be a great time to practice budgeting for housing costs, this estimate also uses the concept that a household should not pay more than 28% of their total income on monthly housing expenses.

How much down payment is needed to buy a home?

The answer varies by loan program and homebuyer financial situation. Misconceptions on this topic are high. As of recent studies, the majority of Americans still believe a 20% down payment is required to buy a home. The truth is that home loan programs range from 3% to 20% down payment on average.

Conventional loans can go as low as 3% but carry more stringent qualifying factors. FHA loans offer a 3.5% down payment option with more relaxed qualifying factors but also carry heavier appraisal requirements and may involve a Mortgage Insurance (MI) factor. Some government programs like VA and USDA will carry 100% financing for eligible homebuyers and/or properties. 100% financing does not mean zero dollars is required for the whole process. There will be processing and underwriting fees as well as closing costs from title and escrow. Borrowers should know that going into a 100% financing loan.

Other home loans will require a higher down payment. Jumbo Loans tend to carry a 10%-20% down payment requirement on average and higher-risk borrowers may be required to put down more in order to qualify.

State and Federal Grants are also available for Down Payment Assistance. These programs help cover the costs of the down payment and transaction for those who are creditworthy and earn enough monthly to cover a monthly house payment but do not have a large chunk to put down. These programs typically require a minimum credit score as well as mandatory Mortgage Insurance and homebuyer classes.

How much time do you need to save for a down payment?

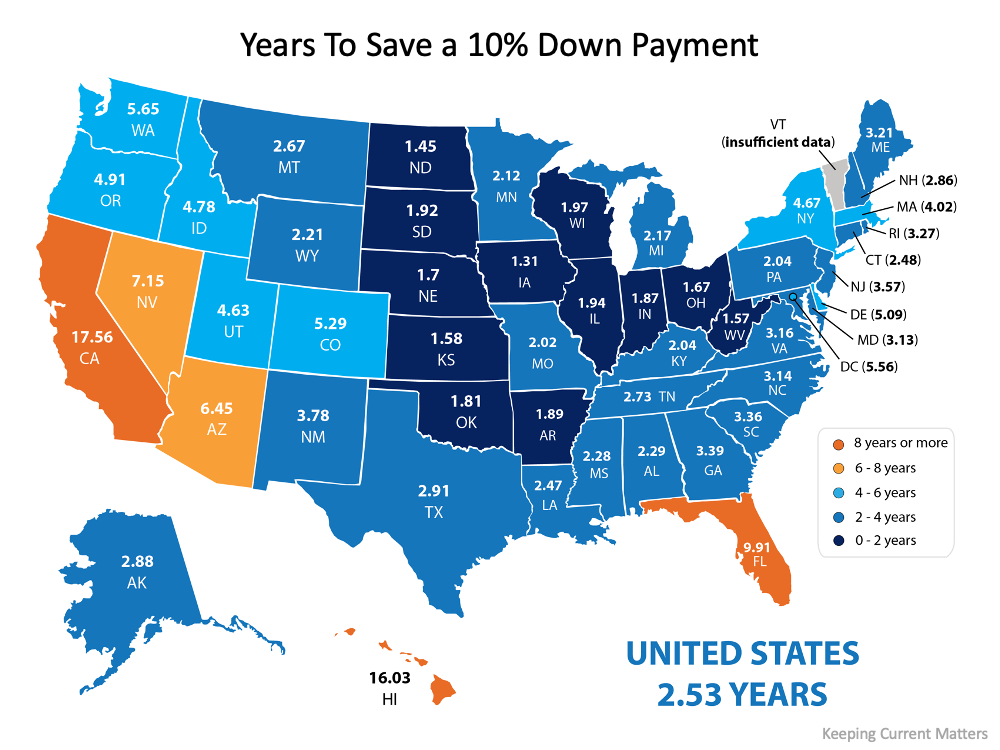

According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

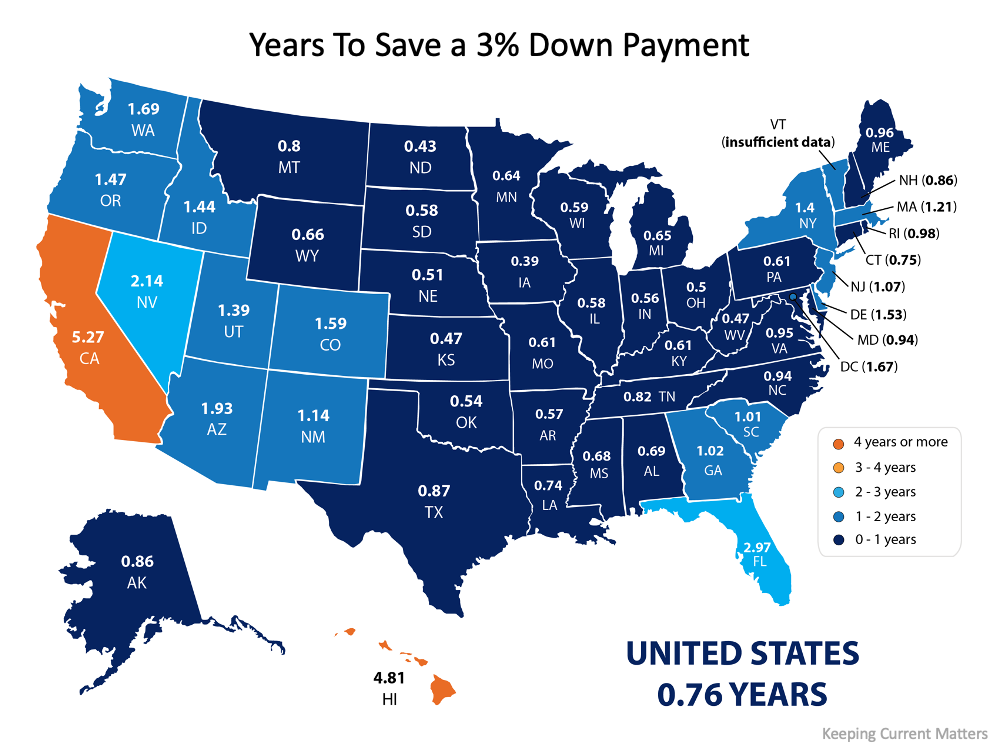

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states.

Saving For Your Down Payment:

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Let’s connect to explore the down payment options available in our area and how they support your plans.

Curious to see what you could qualify for, and what your down payment might look like?