Home>> Fannie Mae To Consider Rent Payments In Underwriting Process

What Does This Mean?

Earlier this month, Fannie Mae declared beginning September 18th they will now factor in consistent rent payments into the decision of determining your eligibility for a mortgage. This is a huge step in making homeownership more accessible for all.

It is but one important step in correcting the housing inequities of the past, creating a more inclusive mortgage credit evaluation process going forward, and encouraging the housing system to develop new ways of safely assessing and determining mortgage eligibility in order to fairly serve all potential homeowners. We look forward to working with our industry partners to do what we can together to address this and other barriers to homeownership.”

Hugh R. Frater, Chief Executive Officer, Fannie Mae

How Does This Benefit Me?

This opens up the doors to a wider range of potential home buyers. For those who may not have a developed credit profile, consistent rent payments can show lenders they are able to take on a monthly recurring payment and help them qualify for a mortgage loan.

Why is this important?

Credit is currently a huge component that determines your ability to qualify for a mortgage loan. To browse qualifications for current loan programs, read more here.

A large percentage of potential homeowners state that lack of credit is the biggest factor preventing them from purchasing a home. Fannie Mae hopes to improve that statistic and increase the opportunity for homeownership across the board.

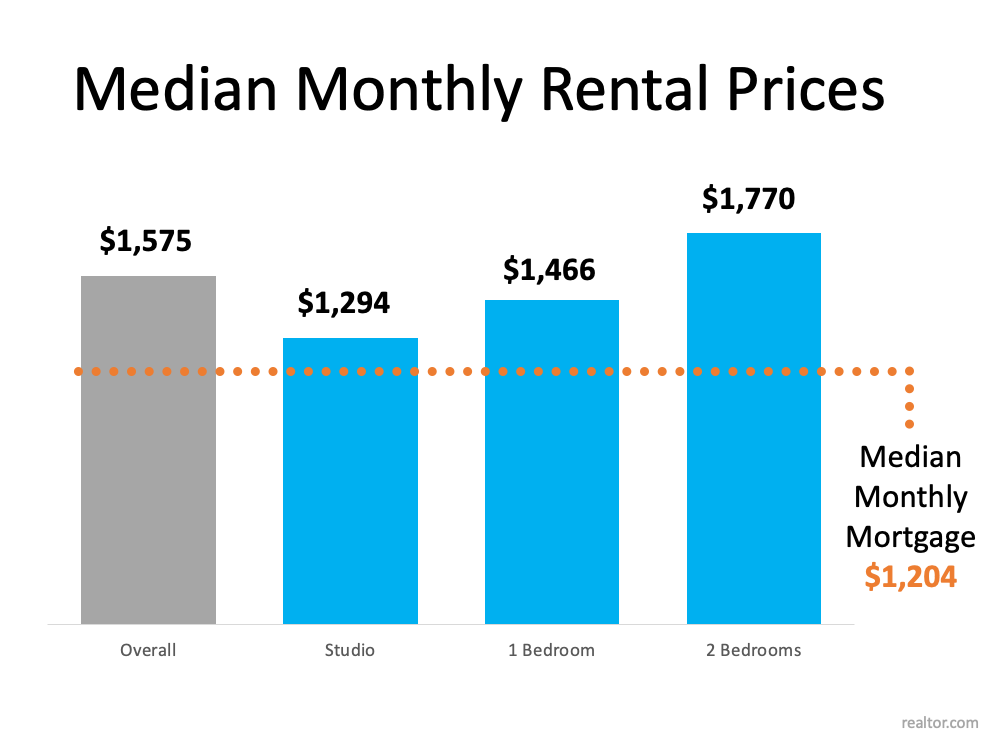

On average, rent payments are often higher than mortgage payments. The problem is many times renters do not meet the strict qualifying guidelines that are required in order to obtain a mortgage. With the implementation of Fannie Mae’s new underwriting considerations, owning a home may be more obtainable than you think.

With the median monthly mortgage payments sitting around $1200 and the monthly rent payment upwards of $1700 a month. Financially, it may benefit you to purchase a home. Not only do you have access to a potentially lower monthly payment, but you are also gaining equity in your home as well. To read more about the benefits of owning versus renting click here.

Renters face increasing costs every year. When you purchase your home, your mortgage rate is locked in for 30 years, meaning your monthly payment stays the same over time. That gives you welcome peace of mind and predictability for many years ahead.

If you have been paying rent and are looking to get prequalified to purchase a home, your rental history may come in handy. Talk to a mortgage professional today about your options

Home Payment Calculator:

Curious to see what your housing payment could like like? Use our free mortgage calculator below: