Mortgage News>> Market Update January 2023

COMMENTARY: THE YEAR AHEAD

For nearly 20 years I have been creating a Market Update for my previous, current, and prospective clients – as well as for my employees, and my mortgage family.

This monthly exercise is not to provide entertainment, nor to sell you a home or mortgage. It is simply to educate. To do my very best to gather information and data to help people make better, and more informed financial decisions, predominately pertaining to real estate. To create a more personal, human interaction with people regarding home financing.

January’s Market Update is not doom and gloom. The information is either factual (what is happening now), and/or speculation based on a lot of data we know to be true today. No one is forecasting a catastrophic event, only challenging times ahead. Staying educated is your best tool to navigate good times and bad. I hope to inspire critical thinking and help enable all to become more financially fit. Often what you need to hear, you may not want to hear. Is 2023 a great time to purchase a home? For some.

Dive into the market update below for a look into what promises to be an interesting year in the very least.

Aaron VanTrojen

CEO, Geneva Financial

2023 OUTLOOK

Turbulent times lie ahead for the U.S. economy and housing. The Fed continues its fight to stomp out run-away inflation while trying to prevent another recession. The stock market swings back and forth as speculation runs wild. The unknown builds and consumers begin to hunker down; potentially creating a self-fulfilling prophecy. The year has just begun, and there are so many unforeseen events that lie ahead, but here are some likely scenarios based on the information that we have today.

Inflation is still high. The Fed target is 2.0%, currently hovering around 7.0%. While the economy is cooling, more rate hikes are on the way. The Fed meets again on January 31st through February 1st and will likely announce a 25 BPS – 50 BPS short-term rate hike. Their words will have a greater impact on the markets than an already anticipated hike. If the economy continues to show signs of weakness, the Fed may hint at a near-term pause on financial tightening. It is still anticipated that any loosening will not occur until late 2023, or early 2024.

A recession is almost imminent. A mild recession could be a healthy reset of the economy. Any recession will cost jobs, but the job market is still too hot. A recession will also lead to lower interest rates. Short term, and long-term. This creates a cycle of economic growth once again. If the Fed does navigate a mild recession, the positive effects of that recession on the economy will not likely be felt until 2024.

Home values are falling and will continue to fall for the foreseeable future. Home value experienced 40% appreciation in 2020-2021 – a rate that is unhealthy and entirely unsustainable. Housing is the commodity that experienced the greatest inflation. If values fell 15% nationwide, we would be testing a “healthy” market. For homebuyers, this is great news. Today prospective buyers can make offers under list price, and request seller concessions to help lower interest rates and improve affordability. It is a buyer’s market and will likely last through much of 2023.

When the Fed pivots and moves to financial easing to either prevent or pull us out of recession, long-term interest rates will start to pull back. Assuming the job market is not in a dire situation and we have avoided a deep recession, home buyers will grow in numbers and the demand for housing will return. Because most home builders have decreased or stalled production, a housing shortage will once again present itself. Values stand to surge again as lack of inventory will become a pain point. Bad for buyers. Good for homeowners. The cycle continues. Based on information available today, this is not anticipated to happen until sometime in 2024.

Remember, everything is speculative and can change at a moment’s notice due to some unforeseen event; or potentially something that has been staring us in the face the whole time. Listen closest to the things you do not want to hear.

JOB MARKET IS WAY TOO HOT

On Thursday, January 5th the Dow plunged nearly 340 points due to an extremely strong jobs report. Private payroll grew by 235,000 in December, far higher than the Dow Jones estimate of only 150,000. While that may seem counterintuitive, the Fed, in its fight to pull back inflation, has been working tirelessly to cool the job market. Strong job growth will lead to higher rates. Higher rates increase costs to businesses.

The economy is still way too hot. The stronger than expected jobs report increases the likelihood of another rate hike in February. It will also influence the size of that rate hike.

UNDERWATER AND DROWNING

A recent study provided by Black Knight found that 1 in 12 homes purchased in 2022 are already underwater. Meaning the homeowner now owes more than the home is worth. If the economy stays relatively strong, this will not pose a big threat to US housing. If we fall into a deep recession, a surge in foreclosures may come to fruition.

As home values continue to decline, more and more homes that were purchased in 2022 will have negative equity. Most homes purchased in 2022 were also purchased at a much higher interest rates than those homes that were purchased in 2020/2021. When interest rates inevitably fall, many new homeowners may find themselves unable to refinance due to lack of equity, or negative equity. This will have the greatest impact on those that purchased homes with lower or zero down payments.

Homeowners that purchased prior to 2022 likely are at low interest rates already and have experienced vast appreciation and will remain positive in equity. What about those that purchased in 2023? Values will fall, as will interest rates. If it is a long-term hold, value is less relevant assuming you are not overleveraged, especially if there is a downturn in the economy. Don’t assume that when rates fall you will be able to capitalize on a refinance, as that will require equity.

There is never a more important time to meet with a mortgage professional that truly is looking out for your financial interest. Lots of people will just sell you a house. It is critical that you are well educated of the rewards of home ownership, and the risks. Start this process well before you are ready to purchase. Today is not the best time to buy a home for all. For some, yes. That all depends on one’s financial plan and situation. A consultation from a true mortgage professional should be free and could have tremendous financial implications for your future.

FHA UNDER PRESSURE

“According to the 2021 HMDA [Home Mortgage Disclosure Act] data, the median income of FHA borrowers is $65,000 per year, compared to $85,000 for VA and $105,000 for conventional borrowers.” – housingwire.com

FHA borrowers generally only put 3.5% down when purchasing a home, and some FHA homebuyers use down payment assistance, creating a 0% down payment transaction. FHA borrowers generally have lower credit scores than conventional borrowers, and higher debt to income ratios. FHA allows debt to income ratios as high as 56% (with automated underwriting approval), considerably higher than conventional financing.

“In addition, some 75% of all high loan-to-value (LTV) mortgages made in the nation to first-time homebuyers with credit scores below 680 are insured by the FHA, and the bulk of all high-LTV loans to Black, Latino and rural borrowers are FHA-insured, the agency’s most recent annual report states.” – housingwire.com

Home prices are falling, and nearly 25% of all FHA mortgage originated in 2022 are already in a negative equity position. That is a lot of people that already owe more than the property is worth. Black Knight shows that 75% have less than 10% equity. People that statistically are not in as strong of a financial situation as conventional borrowers.

What happens as values continue to slide, and the economy falls into a likely recession?

Today, FHA delinquencies are historically low. That is the good news. The bad news is that the tide is already turning, and at a time the economy is cooling.

All is not coming up roses on the loan-delinquency front for FHA, however. Over the past eight months, the agency’s 30-day delinquency rate has been creeping upward, going from 2.72% as of April 1 to 4.35% as of Dec. 1, according to Recursion’s data. In addition, FHA’s early-payment default (EPD) rate, a measure of loans that become seriously delinquent within the first six months of the mortgage, also has been rising this year and is at its highest level since 2009, according to the most recent Black KnightMortgage Monitor report. – housingwire.com

The sky is not falling on FHA. Not yet. FHA is well capitalized and can weather a mild recession, and a mild pull back, not only home prices but also employment. If home prices experience a sharp correction of 20%, and the U.S. falls into a severe recession, FHA could be in trouble. The conversation is happening because a real risk does exist.

MORTGAGE INDUSTRY WOES

The mortgage industry posted historic profits in 2020 and 2021 as the world fell into recession due to a global pandemic; so not a lot of tears shed for the industry in 2022 when it got its teeth kicked in.

Fourth quarter numbers are not in yet, but the third quarter was bleak. Mortgage bankers through the third quarter reported a net loss of $624 per transaction. Net loss! That compares to a net gain of $2,594 per loan in Q3 of 2021, per the Mortgage Bankers Association.

November experienced one of the largest month over month drops in volume falling 22%. Fourth quarter losses are anticipated to trump Q3 for most of the industry.

JUMBO DEMAND SINKS

Originations of big-ticket home mortgages fell sharply in the third quarter as rising interest rates made such transactions increasingly unaffordable.

An estimated $105.46 billion of single-family mortgages exceeding the agency loan limit were produced in the third quarter, down 32.2% from the previous period, according to a new tally from Inside Mortgage Finance. The figure includes both non-agency jumbos and high-balance loans delivered into agency MBS, some of which were originated in prior periods.

Meanwhile, total first-lien originations fell 23.2% from the second to the third quarter. A big drop, but not as severe as the nosedive in jumbos.

Originations of non-agency jumbo loans were down a whopping 34.8% during the third quarter to an estimated $88.0 billion. – Inside Mortgage Finance

U.S. NATIONAL DEBT

The U.S. now stands at $31.5 Trillion and climbing. US Federal Debt to GDP Ratio:

Source: usdebtclock.org

GENEVA FINANCIAL, LLC NOW LICENSED IN 47 STATES

Now Lending in Alaska

Alabama, Alaska, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., West Virginia, Wisconsin, Wyoming

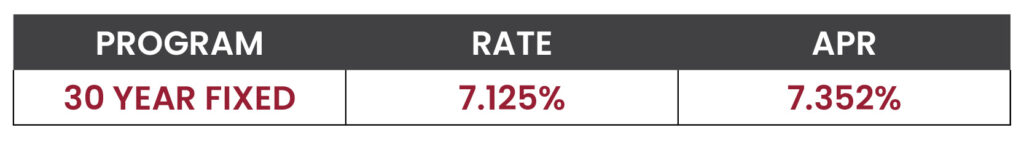

RATE WATCH – HIGHER

APPLY ONLINE: www.genevafi.com

Interest rates as of 01/05/2023. Conforming interest rates. Interest rates and APR based on loan amounts not to exceed $726,200. Loan to value not to exceed 80%. 740+ credit score. Owner occupied only. Purchase and rate in term refinances. Not all applicants will qualify. Call today for your individual scenario rate quote.