Mortgage News>> Market Update September 2022

Check Today’s Rates for Mortgage and Refinance

NEW HOME SALES TUMBLE

The US economy is in a recession (by definition) and housing is taking the brunt of it. New Home Sales in August fell 12.6%; far exceeding the estimates of a 2.7% decline. Remember all the cries of “no inventory?” Inventory is now at a 10.9-month supply, substantially higher than the 4–6-month supply required for a “healthy market.” Even the experts seem to be caught off guard, yet there have been alarms going off for months. The very beginning of a housing recession, that has been building for months. Inflated home values caused by a government-subsidized economy, rapidly rising interest rates, and very low demand equates to a correction. Just because you keep saying “low inventory high demand,” does not make it so.

Home sales contract cancelations are also on the rise, nearly doubling over the last few months.

EXISTING HOME SALES SLUMP

Existing home sales fell 20.2% last month, the steepest decline in years. Despite the lack of existing home sales, home prices stay resilient, up 10.8% in July over last year. Down 5.9% over June. – cnbc.com

We are now in a buyers’ market. Rising inventory and rapidly decreased new and existing home sales will lead to falling home prices. The days of overbidding are over. The days of seller paid closing costs are upon us. Buyers now have choices and buying power. While interest rates are higher than a year ago, there is much speculation that there will be refinancing opportunities in the not-so-distant future. Yet a drop in interest rates will also give rise to higher demand. This window of opportunity for buyers may be short lived.

FEDERAL RESERVE DROPPING THE HAMMER

On July 27th, the Federal Reserve raised the federal funds rate by another 75 basis points in an aggressive attempt to stomp out inflation. Four rate hikes in 2022 alone, for a cumulative total of 225 basis points; the fastest rising in rates in nearly two decades. Short term rates have been raised, and long-term rates will continue to follow, at least for the near future. The goal is to slow inflation and create more affordable housing. Both are underway. If well executed, the Fed could navigate a healthy landing and normalize the US economy. The Fed is anticipated to raise rates once again in September. The Fed also anticipates pulling interest rates back sometime in 2024.

FANNIE MAE PROFITS RISE

While the mortgage industry is experiencing its worst year since 2008, Fannie Mae’s profits are up. Fannie Mae reported a $4.7 billion net income in the second quarter of 2022. That is up from the first quarter of 2022 when it reported $4.4 billion.

Fannie Mae reported $4.7 billion in net income for the second quarter of 2022, up from $4.4 billion in the first quarter. – housingwire.com

While profits are on the rise, so are high-risk loans that the Agency is purchasing.

The share of refinances the company purchased in the second quarter of 2022 decreased to 36%, compared to 65% a year ago. Purchase loans have higher loan-to-value ratios, pushing the GSE’s share of mortgages with loan-to-value ratios over 80% from 22% this time last year to 34% in the second quarter of 2022.

That mix of refinances and purchase acquisitions also impacted the debt-to-income ratio of loans Fannie Mae bought, and the underlying credit score. In the second quarter of 2022, 22% of the loans Fannie Mae acquired had debt-to-income ratios over 45%, versus 14% of loans in the second quarter of 2021. The share of loans the GSE bought with a credit score at or above 740 was down to 61% in the second quarter of 2022, from 70% the year prior. The share of loans with credit scores below 680 grew to 9%, up from 6% this time last year. – housingwire.com

Fannie Mae’s income grew largely due to the fees it increased from last year because of the weaker credit profile of the loans the Agency is purchasing. If defaults stay low, profits should be obtainable. In today’s economy, that is a big “if.”

HOUSING STARTS INDICATE HOUSING WOES

Single-family housing starts dropped 10.1% in July over June, according to a recent report by the US Department of Housing and Urban Development. Down 18.5% year over year. Rising rates and rapidly declining demand have made home builders pump the brakes. The cost of construction is still inflated due to supply chain disruption and demand, and builders do not want to get caught holding inventory at an inflated cost with little or no demand. Prices are falling, yet the cost to build remains high. All are compounded by rapidly rising interest rates causing a problem in affordability.

If the Fed pulls rates back in 2024, as stated, demand may once again surge. Builders will be behind in starts, and inventory will fall. The cycle repeats itself.

MORTGAGE DEMAND DROPS

Mortgage demand fell 2.3% in mid-August, reaching the lowest levels in 22 years. Down 18% from one year ago. Refinance demand is down 82% from one year ago. – cnbc.com

The Mortgage Bankers Association Wednesday morning said new residential loan applications for the week ending Aug. 12 fell 2.3% on a seasonally adjusted basis from the prior week while the trade group’s unadjusted purchase index was off 18.0% from a year ago.

“Home purchase applications continued to be held down by rapidly drying up demand, as high mortgage rates, challenging affordability, and a gloomier outlook of the economy kept buyers on the sidelines,” said Joel Kan, MBA’s associate VP of economic and industry forecasting.

Also, data analytics firm Redfin issued a new report saying roughly 63,000 home-purchase agreements were canceled by homebuyers in July, representing 16.1% of contracts that were entered into that month.

According to figures compiled by Inside Mortgage Finance, home originators funded $1.375 trillion of first liens during the first six months of 2022, off 41.6% from the first half of 2021. – Inside Mortgage Finance

Mortgage demand is projected to remain low until the Fed pulls back on interest rates. Currently scheduled for 2024.

GOVERNMENT LOANS PRODUCTION DOWN

FHA and VA mortgages that originated in the second quarter of 2022 were down 10.2% over the first quarter, and sharply down 39.6% year to date. – IMFNews.com

Government loans as a percentage of total loan volume originated are expected to climb as credit quality declines.

RENTS HIT RECORD HIGH

National rent averages hit a record high in July. The new monthly rent average is $1,879 per month, up 12.3% year over year. – Realtor.com

As the housing market cools, rental prices should also fall; although it may take some time to see any meaningful drop as rents tend to be trailing.

HOME VALUES SHOW STARTING SIGNS OF WEAKNESS

Home prices declined 0.77% from June to July, the first monthly fall in nearly three years. – Black Knight

While the drop may seem small, it is the largest single-month decline in prices since January 2011. It is also the second-worst July performance dating back to 1991, behind the 0.9% decline in July 2010, during the Great Recession.

Some local markets are seeing even steeper declines over the last few months. San Jose, California, saw the largest, with home prices now down 10% in recent months, followed by Seattle (-7.7%), San Francisco (-7.4%), San Diego (-5.6%), Los Angeles (-4.3%) and Denver (-4.2%). – housingwire.com

The housing market needs to correct to return to “healthy.” Rapid appreciation of 10, 20, or even 30% as seen in some markets is unsustainable. The sudden rise in home values was also due almost entirely to government subsidy, which is now absent. Very few experts anticipate a pullback seen in the 2008 Great Recession, but some markets could see 20% or more. The supply chain continues to come back online, with an overabundance of labor, new homes will be far less expensive to build than the cost of an existing home; that is, without a correction of the existing home price. Net result, existing home prices are coming down. Great news for prospective home buyers.

U.S. NATIONAL DEBT

The U.S. now stands at $30.87 Trillion and climbing.

GENEVA FINANCIAL, LLC NOW LICENSED IN 47 STATES

Now Lending in Alaska

Alabama, Alaska, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., West Virginia, Wisconsin, Wyoming

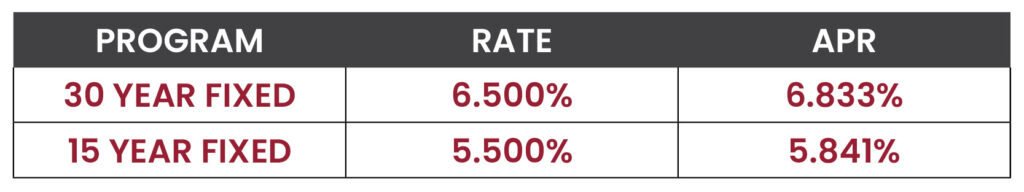

RATE WATCH – HIGHER

APPLY ONLINE: www.genevafi.com

Interest rates as of 09/06/2022. Conforming interest rates. Interest rates and APR based on loan amount not to exceed $647,200. Loan to value not to exceed 80%. 740+ credit score. Owner occupied only. Purchase and rate in term refinance. Not all applicants will qualify. Call today for your individual scenario rate quote.