Mortgage News>> Market Update May 2021

Check Today’s Rates for Mortgage and Refinance

HOTTEST HOUSING MARKET EVER

Housing inventory was low in 2020 prior to the pandemic. With historically low interest rates and a disrupted supply chain, the demand for housing has spiked to epic levels. Demand is high, and inventory is falling. According to a new report from Black Knight, there are 40% fewer homes on the market today, than at the same time last year. That is a massive decline in inventory.

Instead of making up for the shortfall, new listings have slumped further in 2021. Year-over-year, new listing volumes were down 16% in January and 21% in February — amounting to a 125,000 deficit in inventory compared to the same time in 2020.

“Any hopes of 2021 bringing an influx of homes to the market and lessening pressure on prices appear to be dashed for now,” said Ben Graboske, Black Knight’s data, and analytics president.

Buyers who were fortunate enough to snag an available single-family home – new listings are down 46% from a year ago – paid a premium. In February, the median single-family sales price rose nearly 16% from last year.

Home prices in most big cities also increased due to low inventory. In nearly three-quarters of the 100 largest U.S. markets, annual home prices grew more than 10%. Overall, home prices grew 11.6% year-over-year in January, the most growth in a single year since 2005. – Housingwire.com

Falling interest rates set off the buying frenzy in Q2 of 2020 as long-term fixed rates fell for some borrowers, to the mid-to-high 2%s. While rates have ticked up in 2021, a well-qualified borrower can still find interest rates in the 3%s. The recent rise in rates is only going to have a nominal impact on demand.

Demand has pushed inventory lower and prices higher, with most homes receiving multiple offers within hours of coming onto the market. Many are selling over list price, and appraised value. Financing is based on the list price or appraised value (whichever is lower), causing borrowers to need more cash in hand when being pre-qualified.

The supply chain has also been disrupted by the pandemic. The production of many products needed to build homes is not at full capacity. High demand and supply chains not running at full production have radically increased the cost of materials needed to build a home. Lumber prices surged, tripling in cost over the last year. Builders are waiting for long backorders for roofing, windows, AC units, etc. The cost to build homes is spiking, further increasing costs to home buyers.

In February, the median existing-home price rose 15.8% from a year earlier to $313,000, NAR said. – Wall Street Journal

While there is no end in sight to rising home prices, double-digit appreciation is unsustainable long term. At some point, there will not be enough borrowers who can qualify for the inflated prices. Builders are a long way out from replenishing inventory. It will likely be the distant future before the housing market experiences any relief from rapidly growing prices.

UNSUSTAINABLE HOUSING MARKET

In March, home prices surged to an 18% increase over the same period last year. Per Redfin, the median home price is now $356,000. The average time on the market was only 21 days, and 46% of homes sold within a week. – housingwire.com

Is there an end in sight? This is one market that will be hard to resolve in a short period of time. Interest rates are still extremely low, increasing demand. The economy is recovering at remarkable speeds, bring more buyers into the market. Many homeowners now have interest rates in the 2%s and are opting to remodel, vs sell. And construction costs are soaring, making it challenging for builders to build affordable housing.

Bidding wars between buyers willing to pay well over the appraised value will likely persist for the foreseeable future. Qualified buyers using financing will not only have to qualify for a down payment and closing costs but also be about to bridge the gap between the purchase price and appraised value as traditional financing will always be based on the lower of the two.

LUMBER PRICES SOAR

According to the National Association of Home Builders, lumber prices have tripled over the last year, raising the price of an “average” new home by $35,872.

“This unprecedented price surge is hurting American home buyers and home builders and impeding housing and economic growth,” Fowke said. “These lumber prices are clearly unsustainable. Policymakers need to examine the lumber supply chain, identify the causes for high prices and supply constraints and seek immediate remedies that will increase production.” – Chuck Fowke, NAHB Chairman

Trump Administration tariffs, mill shutdowns due to COVID, and a surge in demand are to blame for the skyrocketing lumber prices.

EXISTING HOME SALES FALL

A recent report from the National Association of Realtors shows that in March, for the second month in a row, existing home sales were down 3.7%.

“Consumers are facing much higher home prices, rising mortgage rates, and falling affordability, however, buyers are still actively in the market,” said Lawrence Yun, NAR chief economist. “The sales for March would have been measurably higher, had there been more inventory.”

Total housing inventory at the end of March amounted to 1.07 million units, up 3.9% from February’s inventory but down 28.2% from one year ago (1.49 million). Unsold inventory sits at a 2.1-month supply at the current sales pace, up slightly from February’s 2-month supply and down from the 3.3-month supply recorded in March 2020.

First-time buyers were responsible for 32% of sales in March, up from 31% in February and down from 34% in March 2020. Individual investors and second-home buyers purchased 15% of homes in March, down from 17% in February and up from 13% in March 2020. – housingwire.com

NO CHANGE IN FHA MORTGAGE INSURANCE

There was wide industry speculation that the Federal Housing Authority was in the works of lowering the FHA mortgage insurance premiums by 25 basis points. That speculation can now be put to rest.

“Given the current FHA delinquency crisis and our duty to manage risks and the overall health of the fund, we have no near-term plans to change FHA’s mortgage insurance premium pricing,” Fudge said Tuesday in a statement that accompanied the quarterly report to Congress on the financial status of the FHA’s Mutual Mortgage Insurance Fund. “We will continue to rigorously evaluate our strategy and work transparently with Congress. Our No. 1 priority is helping families keep their homes and remain safe as we work toward an equitable recovery.” – HUD Secretary Marcia Fudge

“The health of FHA’s Mutual Mortgage Insurance Fund has remained resilient despite the financial challenges faced by homeowners with FHA-insured mortgages in 2020,” she said. “The fund stands at more than $80 billion and remains well above the 2% minimum capital reserve required.”

While the fund appears to be well-capitalized, FHA seriously delinquent mortgages increased from 4% to 12% year over year. First payment defaults jumped from 1% to 6%. – Housingwire.com

ADVERSE MARKET FEE HERE TO STAY

In August of 2020, the FHFA added a 50 BPS basis point adverse market fee on all conforming refinance transactions. This was a move to increase revenue for Fannie Mae and Freddie Mac, and potentially prepare for future losses due to the pandemic and defaulting mortgages. In August of 2020, the FHFA projected that the Agencies would incur approximately $6 billion in loan losses due to the pandemic’s impact on borrowers’ ability to pay their mortgages. The FHFA recently reported that there are no plans to eliminate the adverse market fee for the foreseeable future. – Inside Mortgage Finance

QM RULE PATCH REPLACEMENT DELAYED AGAIN

In 2013, the Dodd-Frank regulation created the “Qualified Mortgage.” Part of the rule stated that loans that were to be sold to Fannie Mae and Freddie Mac could not have a debt-to-income ratio over 43%. However, since so many borrowers have a debt-to-income ratio of over 43%, a patch was created that allowed borrowers to qualify with a debt-to-income ratio over 43% if they received an approval from Fannie Mae’s or Freddie Mac’s automated underwriting engines. That patch expired on January 1st, 2021.

Eight years later, the government was unable to create a solution for the expiration of the patch, so, the government kicked the can and extended the patch until July 1st, 2021. On April 27th, 2021, with July 1st rapidly approaching, the CFPB kicked the can again, extending the patch to October 1st, 2022. Maybe nine years will be the magic timeline to save the Qualified Mortgage.

FIRST TIME HOMEBUYER ACT

It is official; President Biden’s first-time homebuyer tax credit is now a bill. If passed, the First-Time Homebuyer Act would give the first-time homebuyer’s a tax credit of up 10% of the purchase price, or $15,000; whichever is lower.

To qualify, the following must apply:

- Potential buyers must not have owned or purchased a home within the past three years.

- Participants must make no more than 160% of the area median income, and the home’s purchase price must be no more than 110% of the area median purchase price.

- Borrowers could claim the credit for primary residences purchased after Dec. 31, 2020.

- Borrowers would need to use the home as a primary residence for at least four years, or face taxes to recover a portion of the credit.

The housing market does not need incentives to buyers, but sellers. The market is too hot without enough inventory. Maybe a tax incentive for people (or Wall Street) to sell their homes. Eliminate capital gains taxes on real estate for the next 1-2 years as an incentive for investors to sell. Just a thought.

U.S. NATIONAL DEBT

For the first quarter of 2021, the U.S. national debt hit an all-time high, growing $1.7 trillion, up 130%, in a single quarter. The U.S. now stands at $28.216 Trillion and climbing.

GENEVA FINANCIAL, LLC NOW LICENSED IN 45 STATES

Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., West Virginia, Wisconsin, Wyoming

Pending: North Dakota

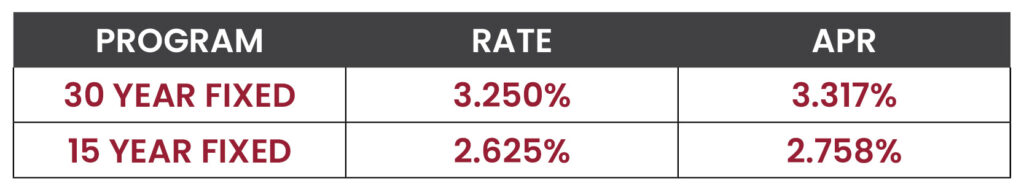

RATE WATCH – LOWER

Interest rates as of 04/29/2021. Conforming interest rates. Interest rates and APR based on loan amounts not to exceed $548,250. Loan to value not to exceed 80%. 740+ credit score. Owner occupied only. Purchase and rate in term refinances. Not all applicants will qualify. Call today for your individual scenario rate quote.