The Federal Housing Administration (FHA) today announced the agency’s new schedule of FHA Loan Limits for calendar year 2021 for its Single Family Title II forward and Home Equity Conversion (reverse) Mortgage insurance programs. The increase is up 7.4% from last year.

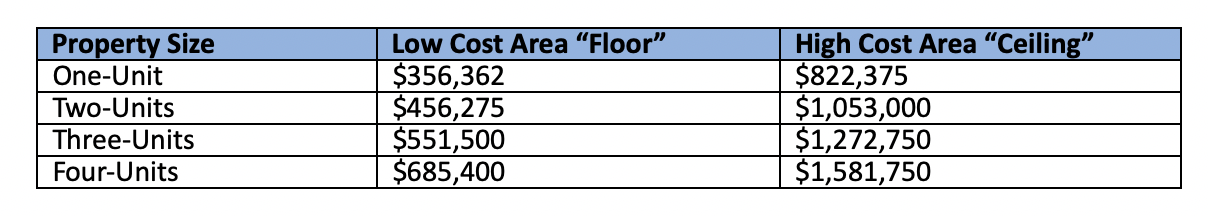

In high-cost areas of the country, FHA’s loan limit ceiling will increase to $822,375 from $765,600. FHA will also increase its floor to $356,362 from $331,760. Additionally, the FHA-insured Home Equity Conversion Mortgage (HECM) maximum claim amount (HECM limits) for reverse mortgages will increase to $822,375 from $765,600.

“FHA has seen consistent increases in loan limits during the past few years, putting it in a position to serve a segment of borrowers that may be better-served by the conventional market. FHA’s mission is to support low-to-moderate income borrowers, so why does the law permit FHA to insure mortgages up to $822,375? This is a question for Congress and the taxpayers who stand behind FHA to answer,” said assistant secretary for housing and federal housing commissioner Dana Wade.

Under HERA, the FHA calculates forward mortgage limits by Metropolitan Statistical Area and county. Due to robust increases in median housing prices and required changes to FHA’s floor and ceiling limits, the maximum loan limits for FHA forward mortgages will rise in 3,108 counties. In 125 counties, FHA’s loan limits will remain unchanged.

There are a number of counties where the 2021 loan limit will be between the floor and the ceiling. Loan limits in those counties, which are based on the median home prices in those counties, vary from just above the floor of $356,362 to just below the ceiling of $822,375.

There are also a few areas where loan limits are calculated differently than the rest of the country due to the specific nature of those housing markets.

As in previous years, Alaska, Hawaii, Guam, and the U.S. Virgin Islands have a higher limit ceiling than the rest of the country to account for the higher costs of construction.

In those areas, the 2020 FHA loan limit is $1,233,550.

Unlike 2020’s report, the FHA said there are no counties where the loan limits will be decreasing.

Back in 2016, the FHA increased loan limits for just 188 counties; in 2017, this number jumped to 2,948 counties; then to 3,011 counties for 2018. In 2019, the FHA loan limits increased in 3,053 counties.

It should also be noted that both the FHA loan limit floor and ceiling are increasing on two-unit, three-unit, and four-unit properties.

According to the FHA, the loan limits are effective for case numbers assigned on or after Jan. 1, 2021, through Dec. 31, 2021.

What does this mean? As a prospective homebuyer, you now have more purchasing power. Use our interactive housing payment calculators to see what your future home payment may look like:

HOME PAYMENT CALCULATOR

<script>

(function(d, s, id) {

var js,sfjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s);js.id = id;

js.src = 'https://sf3.tomnx.com/interactives/embed-interactives.js';

sfjs.parentNode.insertBefore(js, sfjs);

})(document, 'script', 'surefire-interactives');

</script>

<div class="surefire-interactive" data-interactive="jg0H1"></div>REFINANCE CALCULATOR

<script>

(function(d, s, id) {

var js,sfjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s);js.id = id;

js.src = 'https://sf3.tomnx.com/interactives/embed-interactives.js';

sfjs.parentNode.insertBefore(js, sfjs);

})(document, 'script', 'surefire-interactives');

</script>

<div class="surefire-interactive" data-interactive="87eHa"></div>