What is a FHA Loan?

An FHA Loan is a mortgage that’s insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and are especially popular with first-time homebuyers. These loans are designed for low to moderate-income borrowers.

Who can qualify for an FHA Loan?

FHA loans are often a popular choice for a first-time homebuyer. FHA loans require a lesser deposit than a conventional loan and can help keep costs low when purchasing a home. They may also require a lower credit score in comparison to other loans.

What are the requirements for an FHA Loan?

- FICO® score at least 620= 3.5% down payment.

- MIP (Mortgage Insurance Premium) is required.

- Debt-to-Income Ratio < 43%.

- The home must be the borrower’s primary residence.

- Borrower must have steady income and proof of employment.

How To Apply For FHA Loans?

First, you want to determine which loan option is best for you. A variety of factors may play into this decision. We always recommend starting your home buying journey by sitting with one of our licensed loan professionals. An FHA loan is a great option that requires a low down payment and can make buying a home a reality. To see what your mortgage payment could use our interactive mortgage calculators.

FHA Mortgage Insurance

One important item to remember when choosing an FHA loan is that you will be responsible to pay Mortgage Insurance Premium (MIP). Conventional loans will not require you to pay a MIP. This is an additional cost that you will incur on top of your principal and interest (usually wrapped into your mortgage payment on a monthly basis). FHA mortgage insurance is put into place to ensure your FHA lender is against losses if you default on your loan.

The cost of MIP is dependant upon your loan term, loan size, and down payment.

What are the upfront costs associated with an FHA Loan?

There are a few costs associated with the home buying process, and we will break them down below.

The most common fee associated with purchasing a home is appraisal and inspection fees.

In order to determine the value of a home, a third-party appraisal is almost always required. This fee can range in price anywhere from $300-$1000 dollars.

A home inspection is usually required to determine the livability of the home. Home inspectors look to make sure the home is structurally sound. An FHA Home inspection is typically more strict than other loan types.

A credit report is required to move forward with the loan process, and the process of pulling credit usually results in a fee. This fee is typically less expensive ranging from $50-$100.

Lending origination fees. Lending origination fees are typically a flat fee paid to the lender composing your loan.

Title Fees are required fees that are paid to the title company, such as the title search fee and the cost of title insurance usually required by the lender.

HOA fees may be required if the home you are purchasing has a Home Owner’s Association. Some HOA’s require you to “join” which usually comes with a fee that needs to be paid upfront.

Other fees may come up during the loan process, each fee will be outlined on your Loan Estimate form. It’s important to consult your licensed loan professional if you have any questions on any of these items.

What downpayment is required for an FHA Loan?

For FHA, downpayments can be as low as 3.5%, this is typically reserved for borrowers with a higher credit score. A downpayment as high as 10% might be required for those with a lower credit score.

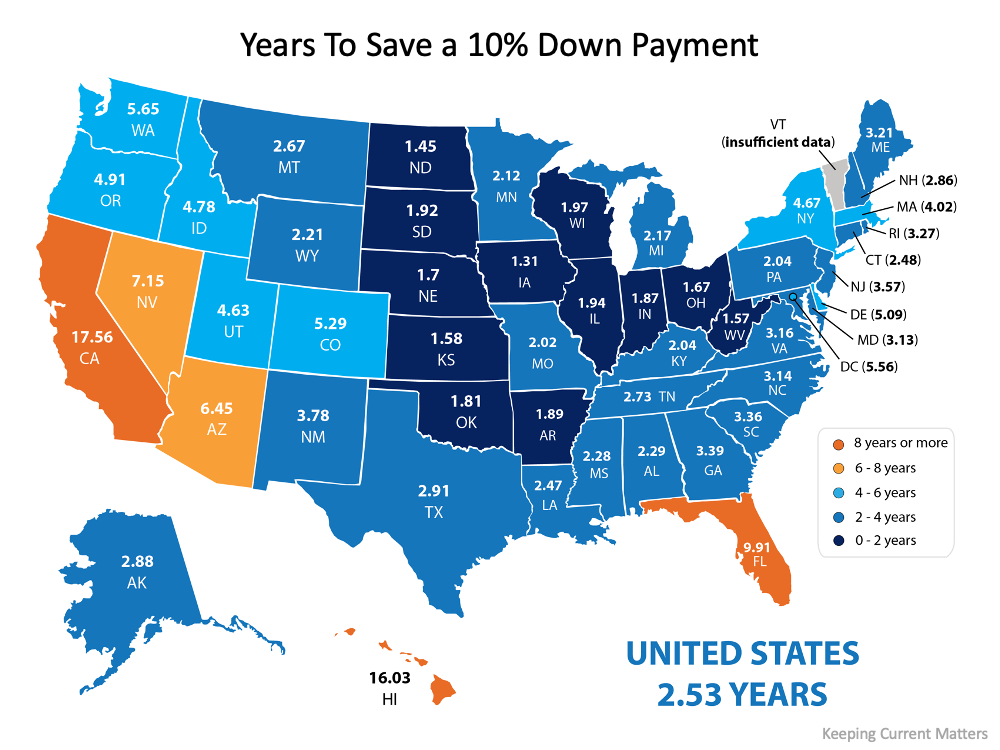

Saving for a downpayment may not actually take as long as you think. According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

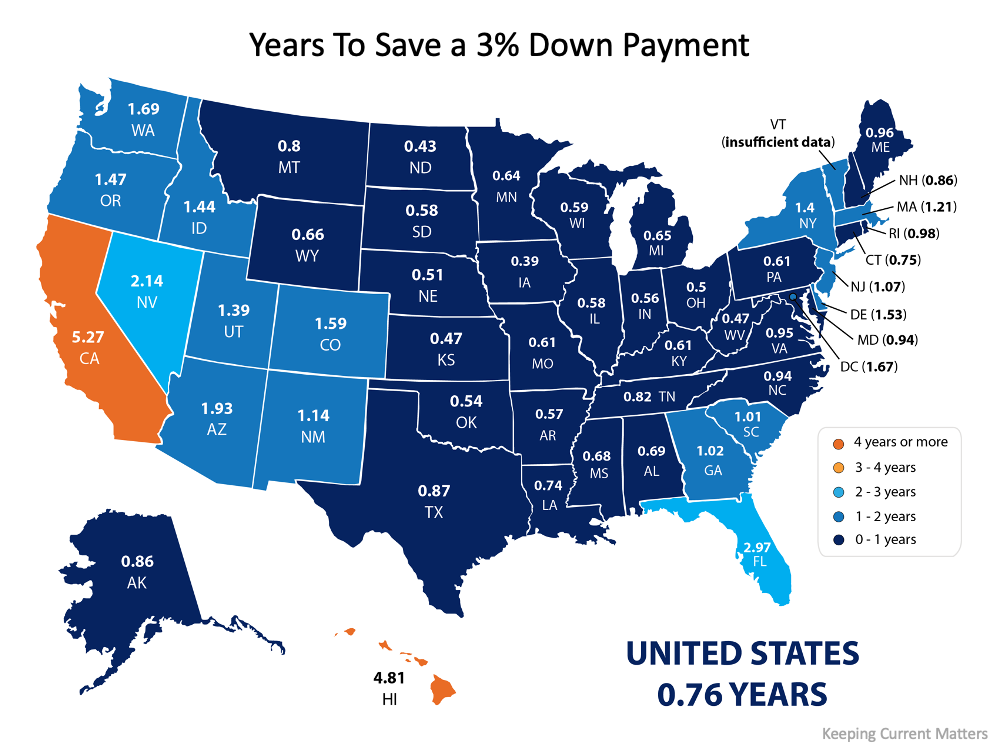

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

What loan terms are available for an FHA Loan?

There is a variety of loan terms available when obtaining a mortgage. The most popular is a 30-year mortgage. Another option is a 15-year mortgage. The difference between the two is the length of the loan. A 15 year will be paid off in 15 years, typically these come with a lower interest rate, due to the length the borrower often pays significantly less in interest over time. A 15-year mortgage however will come with a higher payment than a 30-year loan.

Can you refinance an FHA Loan?

Absolutely, and there are several ways you can accomplish this. An FHA Streamline refinance is a quick way to refinance your home loan.

Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. Streamline refinances are available under credit qualifying and non-credit qualifying options.

The requirements of a streamline may include;

- The mortgage to be refinanced must already be FHA insured.

- The mortgage to be refinanced must be current (not delinquent).

- The refinance results in a net tangible benefit to the borrower. The definition of net tangible benefit varies based on the type of loan being refinanced, and the interest rate and/or term of the new loan.

- Cash in excess of $500 may not be taken out on mortgages refinanced using the streamline refinance process.

- Investment Properties are only eligible for FHA insurance if the borrower is a HUD-approved Nonprofit Borrower, or a state and local government agency, or an Instrumentality of Government.

What other options are available for refinancing?

You can choose a rate/term FHA refinance loan where you are simply refinancing your existing FHA loan into another FHA loan with a lower rate, or different mortgage term.

You can also choose to refinance your FHA mortgage into another loan type if you meet the requirements. This may be beneficial if you are wanting to remove your Mortgage Insurance Premium, tap into your equity for cash back, or lower your rate!

Curious to see if a refinance is right for you? Read more here.

All in all, an FHA Loan is a great option for a first-time homebuyer. With less strict qualifying guidelines and low down payment options, an FHA Loan may be a great fit for you. Curious to see what your mortgage calculator may look like? use our interactive mortgage calculator below:

FIND A LICENSED MORTGAGE LOAN OFFICER

Homes for Heroes & First Responder Mortgages